This is the second of a two-part discussion on the August 13, 2013, the Public Company Accounting Oversight Board (PCAOB) proposal that would result in two new auditing standards. In the first article, I discussed the proposed concept of “critical audit matters” or CAMs. In this article, I discuss the proposed requirements to disclose how long the auditor has been auditing the company and to provide some assurance on “other information” that a registrant must file in an annual filing with the Securities and Exchange Commission (SEC). I conclude this article with some summary thoughts.

Audit, Compliance and Risk Blog

Significant New Auditing Standards—Part 2, Tenure/Other Information

Posted by Ron Pippin on Wed, Aug 28, 2013

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Audit Standards, Accountants

Significant New Auditing Standards—Part 1, Critical Audit Matters

Posted by Ron Pippin on Fri, Aug 23, 2013

On August 13, 2013, the Public Company Accounting Oversight Board (PCAOB) issued a lengthy, 294-page proposal that would create two new auditing standards and amend several existing rules. If finalized, it will likely increase the work load of auditors. Presumably, the PCAOB proposed these rules, not to “help” the pocketbooks of auditors but rather to provide more useful information to investors. Much of this proposal resulted from feedback the PCAOB received on its June 21, 2011, “concept release” on possible changes to the auditor’s reporting model. The PCAOB has now answered my question from a prior blog article, “Where Is the Regulator of Auditors of Public Companies?"

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Audit Standards, Accountants

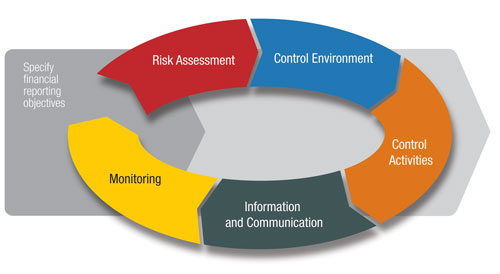

On May 14, 2013, the Committee of Sponsoring Organizations of the Treadway Commission (COSO) issued its final revised “Framework” for internal control reporting. Many accountants and other readers may raise the question, who is COSO and what do they do? Yes, accountants are quite familiar with guidance issued by the Financial Accounting Standards Board (FASB), the Securities and Exchange Commission (SEC), and other standard-setters, but COSO is not a standard-setter. So, this latest version of the COSO Framework arguably is a “sleeper” when it comes to guidance that may affect accountants.

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Lease Accounting, Audit Standards, Accountants

Recent Changes to Disclosure Requirements for SEC Registrants

Posted by STP Editorial Team on Tue, Aug 13, 2013

Actions by the SEC, other federal agencies and the courts continue to change or propose changes to the rules concerning the disclosures that publicly listed companies must make. They are responding to the latest series of U.S. federal laws aimed at improving corporate accountability and enhancing growth in a slow economy. Most recently, a court has vacated the SEC rule on disclosure of payments by resource extraction issuers, and the U.S. Government Accountability Office (GAO) has recommended further disclosures about auditor attestation, as follows:

Tags: Corporate Governance, Business & Legal, SEC, Audit Standards

If government provided a unified approach to chemical regulation, then each chemical might be subject to a single set of requirements, which ideally would be tailored to reflect chemical-specific hazards throughout its life cycle. Instead, each chemical is subject to its own loosely connected (some would say haphazard) collection of environmental, health and safety (EH&S) requirements. Some are federal, some are state (or provincial if you’re in Canada), and others are regional and even local. You may need to refer to agencies at all three levels (federal, state and local) to identify your regulators and their requirements – although many organizations only deal with the agency responsible for permitting and inspecting day-to-day activities.

Tags: Audit Standards, Environmental risks, Environmental, EHS, EPA, Hazcom, MSDS, mact

Will Proposed New Insurance Contract Accounting Rules Apply to You?

Posted by Ron Pippin on Thu, Jul 25, 2013

Companies and users of financial statements should be alert to the potentially far-reaching consequences of a June 27, 2013, proposal issued by the U.S. Financial Accounting Standards Board (FASB). If adopted, the proposal would likely change how certain companies that provide insurance (not policyholders) account for insurance contracts. Maybe most importantly, the proposal would affect financial accounting by many companies that don’t consider themselves an “insurance company.” Financial institutions, including banks, are just one example. Undoubtedly, the scope of this proposal will surprise many—possibly even the FASB. This proposal, titled Insurance Contracts (Topic 834), is a whopping 405 pages in length—not exactly light reading!

Tags: Corporate Governance, Business & Legal, Accounting & Tax, Audit Standards, Accountants, US GAAP, GAAP, Insurance

STP Launches New Industry-Specific MACT Standards Guides

Posted by Lorraine O'Donovan on Fri, Jul 12, 2013

Organizations increasingly need specialized guidance in order to self-audit and show efforts to comply with legislation, and demonstrate due diligence.

Tags: Corporate Governance, Business & Legal, Audit Standards, Environmental risks, Environmental, EHS, mact

The FASB Turns 40—A Look-Back over Four Decades of Rulemaking

Posted by Ron Pippin on Thu, May 16, 2013

The accounting standard-setter for companies in the United States, the Financial Accounting Standards Board (FASB) is celebrating its 40th anniversary this year—and for all 40 years of the FASB’s existence, I have been practicing as a certified public accountant (CPA), both in public and industry accounting. I currently author this blog and work on a consulting basis with companies to help them understand the accounting rules as well as the way in which they are developed and issued by the FASB and other standard-setters. From this perspective, I will provide a mix of historical facts and some of my own personal views on the development of U.S. accounting rules.

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Audit Standards, Accountants, AICPA

Accounting Guidance for Not-for-Profit Entities Is Changing

Posted by Ron Pippin on Fri, May 03, 2013

The Financial Accounting Standards Board (FASB) has recently clarified certain guidance relating to not-for-profit (NFP) entities. Specifically, it has issued Accounting Standards Update (ASU) No. 2012-05, Statement of Cash Flows (Topic 230), Not-for-Profit Entities: Classification of the Sale Proceeds of Donated Financial Assets in the Statement of Cash Flows, and ASU No. 2013-06, Not-for-Profit Entities (Topic 958), Services Received from Personnel of an Affiliate. The latter ASU was issued on April 19, 2013. Separately, the American Institute of Certified Public Accountants (AICPA) in March 2013 issued new guidance in the form of an updated Audit & Accounting Guide (AAG), Not-for-Profit Entities.

Tags: Business & Legal, SEC, Accounting & Tax, Lease Accounting, Audit Standards, Accountants, GAAS, GAAP

This blog article discusses the formal post-implementation review (PIR) process for U.S. accounting standards used by companies, not-for-profit entities, and state and local governments.

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Audit Standards, Accountants, US GAAP, GAAP

.jpg)