The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), under their joint Leases Project, propose to substantially revise the existing rules for lease accounting.

Audit, Compliance and Risk Blog

Currently Proposed Changes to U.S. Lease Accounting Rules

Posted by STP Editorial Team on Fri, Nov 08, 2013

Tags: Business & Legal, Accounting & Tax, Lease Accounting, Accountants, US GAAP, GAAP

Tags: SEC, Accounting & Tax, Lease Accounting, Audit Standards, Accountants

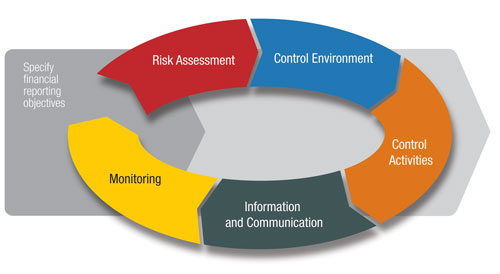

On May 14, 2013, the Committee of Sponsoring Organizations of the Treadway Commission (COSO) issued its final revised “Framework” for internal control reporting. Many accountants and other readers may raise the question, who is COSO and what do they do? Yes, accountants are quite familiar with guidance issued by the Financial Accounting Standards Board (FASB), the Securities and Exchange Commission (SEC), and other standard-setters, but COSO is not a standard-setter. So, this latest version of the COSO Framework arguably is a “sleeper” when it comes to guidance that may affect accountants.

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Lease Accounting, Audit Standards, Accountants

As mentioned in my September 2012 blog article, “Possible New Lease Accounting Rule—An Update,” a new proposal for lease accounting was likely to “hit the streets” sometime in 2013. Sure enough, a new proposal was issued on May 16, 2013. This proposal was issued jointly by the U.S. accounting standard-setter, the Financial Accounting Standards Board (FASB), and the International Accounting Standards Board (IASB), which issues accounting standards that are used by many companies in countries outside the United States. The two boards are striving to conform their accounting principles and this lease project is one example of that effort.

Tags: SEC, Accounting & Tax, Lease Accounting, Accountants

Accounting Guidance for Not-for-Profit Entities Is Changing

Posted by Ron Pippin on Fri, May 03, 2013

The Financial Accounting Standards Board (FASB) has recently clarified certain guidance relating to not-for-profit (NFP) entities. Specifically, it has issued Accounting Standards Update (ASU) No. 2012-05, Statement of Cash Flows (Topic 230), Not-for-Profit Entities: Classification of the Sale Proceeds of Donated Financial Assets in the Statement of Cash Flows, and ASU No. 2013-06, Not-for-Profit Entities (Topic 958), Services Received from Personnel of an Affiliate. The latter ASU was issued on April 19, 2013. Separately, the American Institute of Certified Public Accountants (AICPA) in March 2013 issued new guidance in the form of an updated Audit & Accounting Guide (AAG), Not-for-Profit Entities.

Tags: Business & Legal, SEC, Accounting & Tax, Lease Accounting, Audit Standards, Accountants, GAAS, GAAP

Expected Developments Affecting Accountants in 2013—Part 2, FASB-IASB

Posted by Ron Pippin on Fri, Jan 25, 2013

This is the second of three blog articles on my thoughts on developments that may occur in 2013 in “Accounting Land” in the United States. In this article I discuss the joint projects that the U.S. Financial Accounting Standards Board (FASB) and its international counterpart, the International Accounting Standards Board (IASB), are working on. In my third blog article, I will cover the major activities at the Securities and Exchange Commission (SEC), the Public Company Oversight Board (PCAOB), the American Institute of Certified Public Accountants (AICPA), and, finally, the Governmental Accounting Standards Board (GASB).

Tags: SEC, Accounting & Tax, Lease Accounting, Accountants, IFRS

Expected Developments Affecting Accountants in 2013—Part 1, FASB

Posted by Ron Pippin on Mon, Jan 21, 2013

My last two blog postings discussed what happened in “Accounting Land” in the United States in 2012. But that’s history. What about the future? Let’s dust off the crystal ball and I’ll share with you my thoughts on developments that may occur in 2013, in a series of three blog articles.

Tags: SEC, Accounting & Tax, Lease Accounting, Accountants, US GAAP

2012: A Year in Review for Accountants—Part 1, Accounting Standards

Posted by Ron Pippin on Fri, Dec 21, 2012

As 2012 comes to a close, it is time for accountants in the United States to reflect on new financial reporting rules or developments and what may transpire in 2013. This is the first of two blog articles on the topic. In this article, I cover accounting developments in the United States and internationally. The second article will cover Securities and Exchange Commission (SEC) developments and auditing developments.

Tags: SEC, Accounting & Tax, Lease Accounting, Accountants, US GAAP, GAAP, IFRS, Decision on IFRS

It has been more than two years since the U.S. Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) issued their joint proposal on lease accounting. In fact, the proposal was issued on August 17, 2010, and the boards were seeking comments on their proposal by December 15 of that year.

Tags: Business & Legal, Accounting & Tax, Lease Accounting, US GAAP, GAAP

Lease Accounting - Will There be a New Accounting Standard?

Posted by Ron Pippin on Thu, May 10, 2012

The current rules for lease accounting in the United States go back to 1976 and have been interpreted, modified, amended, and revised numerous times over the years. The existing U.S. accounting standard is complex and, some say, arbitrary because it allows companies to structure transactions to meet the rules of the standard, and helps keep significant liabilities off their balance sheet.

Tags: Corporate Governance, Business & Legal, Accounting & Tax, Lease Accounting, US GAAP