The most basic principle of corporate directorships is that the directors have a fiduciary duty to act in the best interests of their corporation. It has followed closely that directors should serve the best interests of the shareholders – in most circumstances this means all the shareholders, not the majority or some faction to which a director might owe allegiance. Although it’s not so clear how expansively directors should interpret those corporate interests, the trend is toward consideration of more groups of “stakeholders.” The past year has seen important reinforcements for that trend.

Read MoreAudit, Compliance and Risk Blog

Recent Confirmation That Canadian Directors Can Consider Non-Shareholder Interests

Posted by Jon Elliott on Tue, Dec 03, 2019

Tags: Corporate Governance, Business & Legal, Canadian, corporate social responsibility, directors, directors & officers

But there are many other potential risks that could result in lawsuits against corporate directors and officers (D&O). These include an ensuing drop in stock price after an incident, mishandling of personal information, effects of the opioid crisis, sexual harassment allegations, and pollution risk created by the use and disposal of dangerous chemicals used in manufacturing. Even liability suits for mass shootings in the workplace can find their way to directors and officers.

Insurance designed to protect corporate directors and officers has been on the market for almost a century, but it was not until the scandals of Enron and WorldCom in the early 2000s that many executives became more aware of the need for liability protection. While we all remember those two bankruptcies, many may not recall that directors of WorldCom had to contribute their personal assets to settle the D&O claims that ensued.

Today, the risk factors motivating the purchase of additional D&O insurance are compelling, but the type of coverage purchased has a material impact on the limits available to protect directors from liability. As corporate officers reevaluate their current D&O coverage, it is important to thoroughly understand the type of coverage purchased and to quantify a board’s potential risk or “claim severity.”

Understanding and Quantifying D&O Risk

In 2017, 9% of public companies in the United States faced securities class actions—an all-time high. These are highly correlated with ensuing D&O claims, and the risks facing every company continue to grow. A U.S. Supreme Court ruling late last year, for example, now enables litigants to pursue class action suits regarding initial public offerings in state courts, which are commonly perceived to be more sympathetic to plaintiffs. These suits are also generally more expensive to defend because they cannot be consolidated and must be negotiated or litigated case by case.Despite this increase in risk and liability exposure, the market for D&O insurance continues to be soft, with low premiums relative to the potential exposure. There continues to be ample competition for this business, preventing any meaningful increase in pricing. As such, this is a good time for companies to purchase additional coverage as pricing may be at a low point, especially in the excess layers. That said, not all D&O coverages are alike. An understanding of the coverages and their differences is essential for decision-makers looking to evaluate risk mitigation options.

Differences In D&O Coverage

With the introduction of the Private Securities Litigation Reform Act (PSLRA) in 1995, there followed a change in D&O coverage available in the marketplace. PSLRA is a federal law enacted in response to the perceived increase in frivolous class action suits alleging securities fraud under the Securities Act of 1933 and the Securities Exchange Act of 1934. The key features of PSLRA are:

Read MoreTags: Business & Legal, Workplace violence, corporate social responsibility, directors, directors & officers

If You Want Everyone To Know You’re A Transparent and Sustainable Company, Delaware Can Help

Posted by Jon Elliott on Tue, Feb 19, 2019

When companies claim they’re reducing their environmental impacts, how does anyone distinguish actual improvements from greenwashing? A growing number of national and international nonprofits and industry trade associations offer benchmarks and standards that companies can subscribe to, and third parties offer their services to evaluate and validate claims. Effective October 1, 2018 the state of Delaware has added a governmental layer, which Delaware companies can use to submit information and claims under penalty of perjury in order to gain formal state acknowledgement. The state claims this is the first such law.

Read MoreTags: Business & Legal, Environmental, sustainability, corporate social responsibility, directors, directors & officers

Federal Enforcement Falls in President Trump’s First Year

Posted by Jon Elliott on Tue, Aug 28, 2018

President Trump and his agency heads have been clear about their intent to reduce regulatory “burdens” on individuals and organizations. Meanwhile, however, they have tended to talk tough on crime. However, a new report shows that civil and criminal enforcement against corporations fell dramatically during their first year in office, compared with enforcement during President Obama’s term. In July, the nonprofit advocacy group Public Citizen published “Corporate Impunity – ‘on Crime’ Trump Is Weak on Corporate Crime and Wrongdoing.”

Read MoreTags: Business & Legal, Environmental risks, Environmental, EPA, corporate social responsibility

Facebook and its chief executive, Mark Zuckerberg, are being criticized far and wide for the company’s lax privacy practices after it was revealed that the political data firm Cambridge Analytica had used a seemingly innocuous personality test to collect data on 87 million Facebook users, which it combined with data from other sources to develop psychological profiles that were used in support of President Trump’s 2016 campaign. A number of lawsuits have been filed against the site over privacy issues and the Cambridge Analytica incident in particular.

Read MoreTags: Business & Legal, Internet, corporate social responsibility, directors & officers, social media

A lot of time is spent shopping for the right look and for fashion that will flatter or get attention, but are we spending our dollars wisely to make sure that the clothes we wear today will not damage the environment in other parts of the world or in our own backyards tomorrow?

Read MoreTags: Environmental risks, Environmental, Hazcom, sustainability, corporate social responsibility

Latest Department of Justice Guidance for Evaluating Corporate Compliance Programs in Criminal Investigations

Posted by Jon Elliott on Tue, May 23, 2017

Earlier this year, the US Department of Justice (DOJ) Fraud Section issued additional enforcement guidelines to US Attorneys, entitled “Evaluation of Corporate Compliance Programs.” DOJ’s US Attorneys perform these evaluations to weigh whether and how severely an organization might be charged for illegal conduct by directors, officers, or other employees. But individuals may be committing crimes to further the organization’s goals (remember Volkswagen’s recent use of fraudulent means to defeat emission requirements), or for their own purposes despite organizational efforts. For readers in organizations that aren’t encouraging criminal behavior, these guidelines provide important guidance to the design (and implementation) of effective compliance programs.

Read MoreTags: Corporate Governance, Business & Legal, Accounting & Tax, Audit Standards, Environmental risks, Environmental, corporate social responsibility, directors, directors & officers

Finalization of Revised ISO 14001 Standard for EMS

Posted by STP Editorial Team on Mon, Mar 30, 2015

The revision of the ISO 14001 Environmental Management Systems Standard is now in its final stages. The Final Draft International Standard (FDIS) will be released soon for the membership to vote for approval or reconsideration—and voting will continue for two months, at which time, the FDIS will be approved as is, or sent back to the ISO Environmental Management Technical Committee 207 (ISO/TC207). Due to the lengthy and deliberate process built into reviewing and updating ISO standards, it is rare for an FDIS not to be approved.

Tags: Corporate Governance, Business & Legal, Employer Best Practices, Environmental risks, Environmental, corporate social responsibility

Could a Christmas tree find a second job? Yes, as it matter of fact it can. Every year in late December, early January and, in some cases, as late as February, certain researchers, environmental groups and wildlife agencies in North America begin sinking Christmas trees in lakes and ocean waters in the hopes of creating habitat for various types of fish.

Tags: Corporate Governance, Business & Legal, Environmental, corporate social responsibility

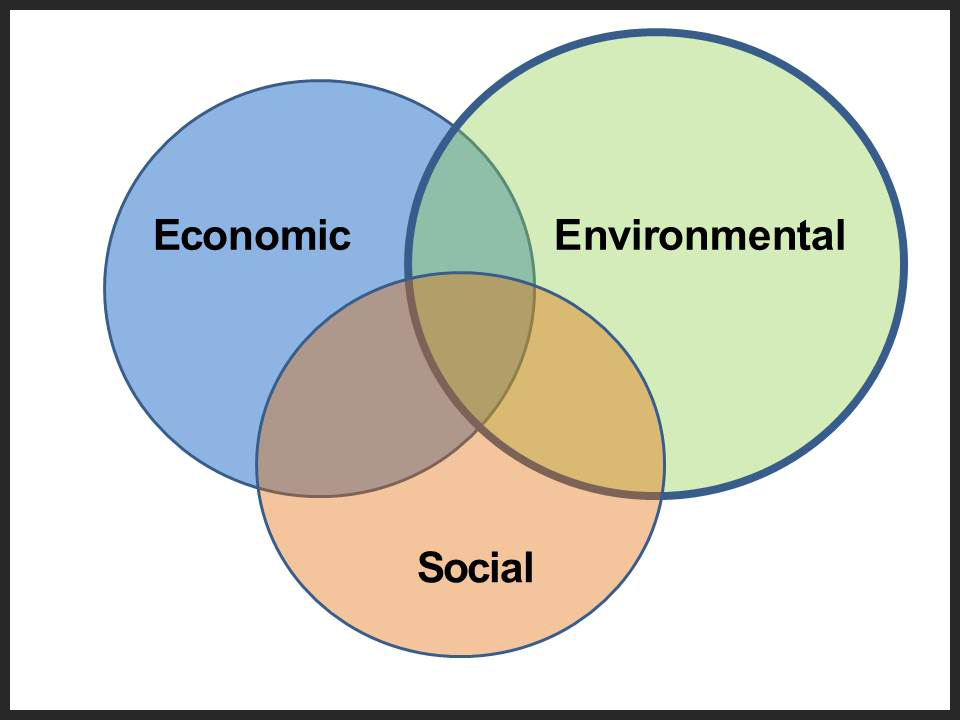

Do You Need A Corporate Social Responsibility Policy?

Posted by Allison Campbell on Thu, Dec 11, 2014

Twelve years ago, a client asked a financial advisor at a large investment firm for advice on “socially responsible investments.” The advisor said that they didn’t offer much in that field, because there was no client demand. How things have changed! Now, large investment firms as well as local credit unions and even small, family-owned businesses are all anxious to demonstrate that their business is “socially responsible,” “green,” or “gives back to the community”—all values reflected in the concept of Corporate Social Responsibility (CSR). More than feel-good slogans, these terms represent initiatives that offer concrete benefits to both a company and its stakeholders, including customers and the wider community.

Tags: Corporate Governance, Business & Legal, Environmental, csr, corporate social responsibility