Section 313 of the Emergency Planning and Community Right-To-Know Act of 1986 (EPCRA, also referred to as SARA Title III) requires selected facilities to file toxic chemical release inventory reports with EPA and their state, on one of two forms (Form R or Form A). This program is often referred to as the Toxics Release Inventory (TRI) program. Filings are due every July 1, so facilities that know or suspect they’re covered should be preparing their annual submissions. The remainder of this blog summarizes TRI requirements.

Read MoreAudit, Compliance and Risk Blog

It’s Time To Submit Annual Toxic Release Inventory Reports

Posted by Jon Elliott on Thu, Jun 27, 2019

Tags: Business & Legal, Health & Safety, Environmental risks, Environmental, EPA, Hazcom

International controls on shipments of plastic waste will increase effective January 1, 2021. Parties to the 1989 Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and their Disposal (Basel Convention) have just adopted amendments to add “plastic waste” to the materials governed by the Convention. The European Union and 186 nations are parties to the Basel Convention; President George Bush signed it on behalf of the United States in 1989, but in the ensuing three decades the U.S. Senate has not yet ratified it. However, the U.S. is subject to requirements adopted by the Organization for Economic Cooperation and Development (OECD), which reflect Basel Convention requirements. Besides, most countries that might receive exports are Basel Convention signatories and should enforce its terms.

Read MoreTags: Business & Legal, Health & Safety, Environmental risks, Environmental, EPA, Hazcom

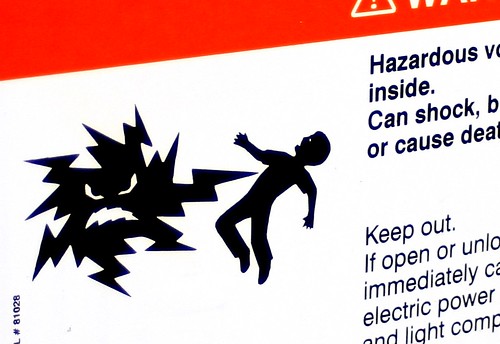

Among its many workplace health and safety standards, the Occupational Safety and Health Administration (OSHA) requires employers to protect employees during equipment servicing and maintenance, to prevent “unexpected” equipment energization, start up, or release of stored energy. OSHA’s Control of Hazardous Energy Standard—more often called the Lockout/Tagout or “LOTO” Standard after its primary compliance requirements—requires employers to establish and implement safety procedures to control such hazardous energy. The LOTO Standard has changed very little since OSHA adopted it in 1989, but the agency has just published a formal request for information – public comments – about two changes in workplace equipment over the past 30 years that might affect energy hazards and justify revisions to the LOTO Standard. The rest of this note summarizes existing requirements and discussed OSHA’s review of control circuits and workplace robotics.

Read MoreTags: Business & Legal, Employer Best Practices, Health & Safety, OSHA, Employee Rights, Hazcom

Occupational Safety and Health Review Commission Confirms Employer’s General Duty Clause Applies to Workplace Violence

Posted by Jon Elliott on Tue, May 14, 2019

On March 4, 2019, the U.S. Occupational Safety and Health Review Commission (Commission) issued its first affirmation of a citation and penalty issued by the Occupational Safety and Health Administration (OSHA) to punish a health care provider under the Employer’s General Duty Clause for failing to take adequate steps to prevent workplace violence. OSHA has issued citations under this Clause since 2012, but this is the first time that the Commission has confirmed one of these citations on appeal.

Read MoreTags: Business & Legal, Employer Best Practices, Health & Safety, OSHA, Employee Rights, Workplace violence

Trump Administration Further Tightens Controls Over Agency Rulemaking

Posted by Jon Elliott on Tue, Apr 30, 2019

The Trump Administration has taken another step to centralize its control over federal agencies’ rulemakings and policy-setting. Rulemaking has always reflected tensions between the politicians who adopt laws, and the agency staff who interpret and apply them through formal rules and information guidance and procedures. Depending how entrenched career staff are in their agencies, there may also be tensions between the elected executive (President, governor, etc.) and his or her agencies, even after his or her appointees are nominally in charge.

Read MoreTags: Business & Legal, EHS, EPA

If You’re In A Flood Zone, Your Insurance Options May Be Changing

Posted by Jon Elliott on Tue, Apr 16, 2019

Millions of people live and work in flood-prone areas, and rely on federal insurance to facilitate their activities. The Federal Emergency Management Agency (FEMA) administers the National Flood Insurance Program (NFIP), under which FEMA defines which flood-prone areas qualify for insurance. In March, FEMA announced plans to change its definitions and underwriting; meanwhile legislation has been introduced in Congress to change NFIP. Depending how these changes turn out, thousands of locations will gain or lose eligibility, and the costs of NFIP insurance could change considerably. As climate change exacerbates the likelihood and severity of floods, the importance of these changing provisions grows – for participants and for the general tax-paying public who often end up subsidizing them.

Read MoreTags: Business & Legal, Environmental risks, Environmental, Insurance, Insurance Claims

But there are many other potential risks that could result in lawsuits against corporate directors and officers (D&O). These include an ensuing drop in stock price after an incident, mishandling of personal information, effects of the opioid crisis, sexual harassment allegations, and pollution risk created by the use and disposal of dangerous chemicals used in manufacturing. Even liability suits for mass shootings in the workplace can find their way to directors and officers.

Insurance designed to protect corporate directors and officers has been on the market for almost a century, but it was not until the scandals of Enron and WorldCom in the early 2000s that many executives became more aware of the need for liability protection. While we all remember those two bankruptcies, many may not recall that directors of WorldCom had to contribute their personal assets to settle the D&O claims that ensued.

Today, the risk factors motivating the purchase of additional D&O insurance are compelling, but the type of coverage purchased has a material impact on the limits available to protect directors from liability. As corporate officers reevaluate their current D&O coverage, it is important to thoroughly understand the type of coverage purchased and to quantify a board’s potential risk or “claim severity.”

Understanding and Quantifying D&O Risk

In 2017, 9% of public companies in the United States faced securities class actions—an all-time high. These are highly correlated with ensuing D&O claims, and the risks facing every company continue to grow. A U.S. Supreme Court ruling late last year, for example, now enables litigants to pursue class action suits regarding initial public offerings in state courts, which are commonly perceived to be more sympathetic to plaintiffs. These suits are also generally more expensive to defend because they cannot be consolidated and must be negotiated or litigated case by case.Despite this increase in risk and liability exposure, the market for D&O insurance continues to be soft, with low premiums relative to the potential exposure. There continues to be ample competition for this business, preventing any meaningful increase in pricing. As such, this is a good time for companies to purchase additional coverage as pricing may be at a low point, especially in the excess layers. That said, not all D&O coverages are alike. An understanding of the coverages and their differences is essential for decision-makers looking to evaluate risk mitigation options.

Differences In D&O Coverage

With the introduction of the Private Securities Litigation Reform Act (PSLRA) in 1995, there followed a change in D&O coverage available in the marketplace. PSLRA is a federal law enacted in response to the perceived increase in frivolous class action suits alleging securities fraud under the Securities Act of 1933 and the Securities Exchange Act of 1934. The key features of PSLRA are:

Read MoreTags: Business & Legal, Workplace violence, corporate social responsibility, directors, directors & officers

On March 11, the Trump Administration issued its budget proposal for federal Fiscal Year (FY) 2020 (October 1, 2019 through September 30, 2020), entitled “A Budget for a Better America: Promises Kept. Taxpayers First.” The proposal includes a 31% cut in the Environmental Protection Agency (EPA) budget, from $8.28 billion in FY 2019 (under a Continuing Budget Resolutions rather than a fully-new federal budget), to $6.07 billion for FY 2020, with corresponding personnel cuts from 14,376 full-time-equivalent employees (FTE) to 12,415. (these are numbers for EPA in the government-wide budget from the Office of Management and Budget (OMBB) summary of the entire budget proposal, and EPA provides additional details on its own website).

Read MoreTags: Business & Legal, Environmental risks, Environmental, EPA

With casinos and other forms of legal gambling proliferating in the United States, you would think that there would be emerging clarity in the laws and regulations regarding gambling online. You’d be wrong. Instead, the law governs Internet gambling in the United States that is still a confusing morass of state and federal laws. Making this even more problematic is that both the federal government and state governments have prosecuted Internet gambling companies, making navigation of the confusing and contradictory rules a dire journey in which a misstep can have major consequences.

Read MoreTags: Business & Legal, Internet

If You Want Everyone To Know You’re A Transparent and Sustainable Company, Delaware Can Help

Posted by Jon Elliott on Tue, Feb 19, 2019

When companies claim they’re reducing their environmental impacts, how does anyone distinguish actual improvements from greenwashing? A growing number of national and international nonprofits and industry trade associations offer benchmarks and standards that companies can subscribe to, and third parties offer their services to evaluate and validate claims. Effective October 1, 2018 the state of Delaware has added a governmental layer, which Delaware companies can use to submit information and claims under penalty of perjury in order to gain formal state acknowledgement. The state claims this is the first such law.

Read MoreTags: Business & Legal, Environmental, sustainability, corporate social responsibility, directors, directors & officers