On July 27, 2012, the Financial Accounting Standards Board (FASB) released Accounting Standards Update (ASU) 2012-02, Intangibles—Goodwill and Other (Topic 350), “Testing Indefinite-Lived Intangible Assets for Impairment.” ASU 2012-02 employs a qualitative concept that is similar to the one developed in ASU 2011-08, Intangibles—Goodwill and Other (Topic 350), “Testing Goodwill for Impairment,” which was issued on September 15, 2011. While the FASB’s issuance of these standards gives companies an option when testing indefinite-lived assets and goodwill for impairment, does it really make impairment testing easier?

Audit, Compliance and Risk Blog

New FASB Accounting Principles Make Impairment Testing Easier—or Not?

Posted by Ron Pippin on Fri, Aug 17, 2012

Tags: SEC, Accounting & Tax, Audit Standards, GAAP

The federal Occupational Safety and Health Act provides employers with a "General Duty" to provide their employees with “safe and healthful working conditions, in workplaces free of recognized hazards” which comply with OSHA standards for general industry.

Tags: Health & Safety, OSHA

Electrical Safety OSHA: Principles and Hazard Controls

FREE! Education Webinar from STC | August 23, 2012

In 2010, 164 workers died after contact with electrical current in U.S. private industry. That amounts to an average of more than 3 deaths per week. In this free education Webinar, our presenter, Barbara Ruble, CPEA, QEP, will discuss the legal requirements related to electrical safety, how to identify electrical hazards, and suggestions for establishing and implementing controls to protect employees, as well as minimize the opportunity for business interruption.

Tags: Health & Safety, OSHA, STP Online, STC, Webinar

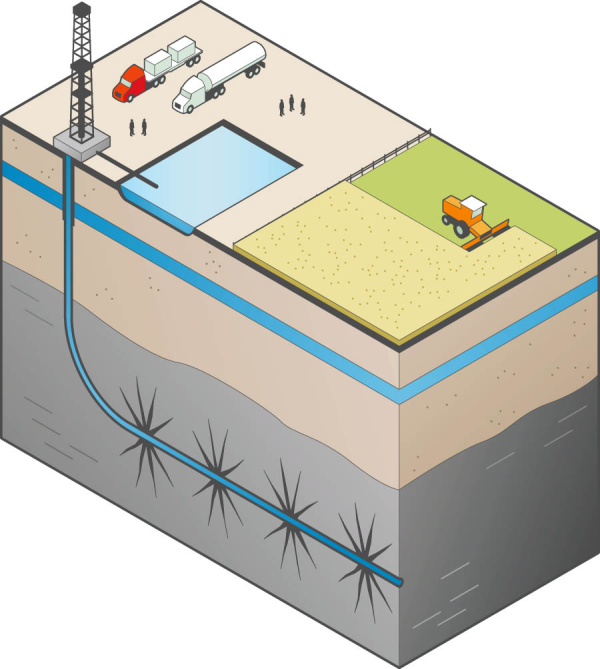

Hydraulic Fracturing: Can We 'Frack' Without Fouling the Environment?

Posted by Jon Elliott on Mon, Aug 13, 2012

Energy companies have used hydraulic fracturing—often referred to as ‘fracking’—since the 1940s in order to enhance recovery of oil and natural gas from low-permeability (“tight”) rock formations.

Frackers pump high-pressure fluids into rock formations to create and expand cracks and create pathways for valuable hydrocarbons to flow out. The stimulant fluids are usually water-based, with additional chemicals (acids, surfactants, biocides, etc.) to improve the effectiveness of the fracking process as well as solid ‘proppants’, which prop open the expanded openings (sand, etc.).

Tags: Health & Safety, Environmental risks, Environmental, EPA, fracking, hydraulic fracking

Greenhouse Gas Emissions: Answering Stakeholders Concerns

Posted by Jon Elliott on Fri, Aug 10, 2012

Increasingly, your approach to climate change issues provides an important basis for your customers’ and other stakeholders’ purchasing and investment decisions with your organization. They may research how your organization manages its greenhouse gas (GHG) emissions (your ‘carbon footprint’) because, if you provide them with goods and services, the GHG emissions associated with your activities may be attributed to them.

Tags: Corporate Governance, Environmental risks, Environmental, EPA

A recent news headline told the story of two nurses who were involved in a scuffle with the father of a newborn inside a New York hospital--apparently, the father was a high profile member of the Kennedy family. The conflict was triggered when he began to carry his infant son out of the hospital without the usual authorized procedures--at which point one of the nurses attempted to block him from leaving.

Tags: Health & Safety, OSHA, Workplace violence

Is Your Board’s Compensation Committee Up to Standard?

Boards of directors are responsible for corporate governance of their companies, although the companies’ executives oversee most day-to-day activities. To ensure that these executives perform properly, the boards oversee them, and establish compensation and incentives intended to encourage and reward appropriate activities. State corporation laws and federal and state securities laws, have traditionally left boards to decide how to meet these responsibilities.

Tags: Corporate Governance, SEC

On July 13, 2012, the staff in the Securities and Exchange Commission (SEC) issued its long-awaited study on developing and executing the February 2010 “Work Plan” to consider whether and possibly how registrants should incorporate International Financial Reporting Standards (IFRS) into the U.S. reporting system.

Many thought the SEC staff would recommend to the commissioners of the SEC an approach that would either require a certain path to migrate U.S. registrants from generally accepted accounting principles that are developed and issued in the United States (U.S. GAAP) to IFRS or some other path. However, the SEC staff made no such formal recommendation.

Tags: SEC, Accounting & Tax, Audit Standards, US GAAP, GAAP

On July 1, 2012, the “Codification” of the Financial Accounting Standards Board (FASB) “celebrated” its third birthday. While CPAs around the world probably did not recognize this event by having cake or singing “Happy Birthday,” or giving gifts, it does prove that conservative accountants can make adjustments to the way they perform their research. Normally, CPAs do not like change but they accepted the FASB’s Accounting Standards Codification reasonably well. If the United States opts for change and decides to follow the accounting rules of the International Accounting Standards Board (IASB) rather than accounting rules of the FASB, the U.S. accounting profession will likely adapt as well—with a wrinkle here and there.

Tags: Accounting & Tax, Audit Standards, US GAAP, GAAP

Court Decision Supports EPA Rulings for Greenhouse Gas Emissions

Posted by Jon Elliott on Thu, Jul 12, 2012

On June 26, the federal District of Columbia Circuit Court of Appeals issued a major decision, upholding four rulings by the U.S. Environmental Protection Agency (EPA). All four rulings expand the regulation of greenhouse gas (GHG) emissions under the Clean Air Act (CAA). The case is Coalition for Responsible Regulation v. EPA.1

Tags: Health & Safety, California Legislation, Environmental, EPA