For the second year running, SEC activities during 2013 were dominated by its efforts to issue rules required by two major pieces of recent legislation:

Audit, Compliance and Risk Blog

Tags: Corporate Governance, Business & Legal, SEC, Employer Best Practices, Accounting & Tax, Accountants, JOBS Act

Derivatives and Hedging: Good News for Dealers and Brokers From FASB

Posted by Viola Funk on Wed, Nov 27, 2013

Dealers and brokers seeking hedging exposures to the Overnight Index Swap rate (OIS) are in luck. The Financial Accounting Standards Board (FASB) recently issued final guidance that allows dealer-brokers to designate the US OIS, the Fed Funds Effective Swap Rate, as a benchmark interest rate for hedge accounting purposes.

Tags: Business & Legal, SEC, Accounting & Tax, Accountants, US GAAP, GAAP

SEC Pay Ratio Disclosure Rule—Comment Period Ending

Posted by STP Editorial Team on Mon, Nov 18, 2013

The SEC voted (3-2), on September 18, 2013, to propose pay ratio disclosure rules as required by Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act. It has issued for public comment until December 2, 2013, its proposed rule, Pay Ratio Disclosure, requiring companies to disclose ratio of the chief executive officer’s (CEO’s) compensation to the median compensation of their employees. According to the SEC staff, registrants are given flexibility in calculating the median employee and total compensation for disclosure purposes based on their size, structure, and how they compensate their employees. Stakeholders who would like to have their views considered should act quickly to meet the December 2, 2013, deadline.

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Accountants

Currently Proposed Changes to U.S. Lease Accounting Rules

Posted by STP Editorial Team on Fri, Nov 08, 2013

The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), under their joint Leases Project, propose to substantially revise the existing rules for lease accounting.

Tags: Business & Legal, Accounting & Tax, Lease Accounting, Accountants, US GAAP, GAAP

CEO/Worker Pay Ratio—SEC Proposes Controversial and Costly Statistic

Posted by Ron Pippin on Wed, Oct 02, 2013

Tags: Corporate Governance, SEC, Accounting & Tax, Accountants

Tags: SEC, Accounting & Tax, Lease Accounting, Audit Standards, Accountants

Significant New Auditing Standards—Part 2, Tenure/Other Information

Posted by Ron Pippin on Wed, Aug 28, 2013

This is the second of a two-part discussion on the August 13, 2013, the Public Company Accounting Oversight Board (PCAOB) proposal that would result in two new auditing standards. In the first article, I discussed the proposed concept of “critical audit matters” or CAMs. In this article, I discuss the proposed requirements to disclose how long the auditor has been auditing the company and to provide some assurance on “other information” that a registrant must file in an annual filing with the Securities and Exchange Commission (SEC). I conclude this article with some summary thoughts.

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Audit Standards, Accountants

Significant New Auditing Standards—Part 1, Critical Audit Matters

Posted by Ron Pippin on Fri, Aug 23, 2013

On August 13, 2013, the Public Company Accounting Oversight Board (PCAOB) issued a lengthy, 294-page proposal that would create two new auditing standards and amend several existing rules. If finalized, it will likely increase the work load of auditors. Presumably, the PCAOB proposed these rules, not to “help” the pocketbooks of auditors but rather to provide more useful information to investors. Much of this proposal resulted from feedback the PCAOB received on its June 21, 2011, “concept release” on possible changes to the auditor’s reporting model. The PCAOB has now answered my question from a prior blog article, “Where Is the Regulator of Auditors of Public Companies?"

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Audit Standards, Accountants

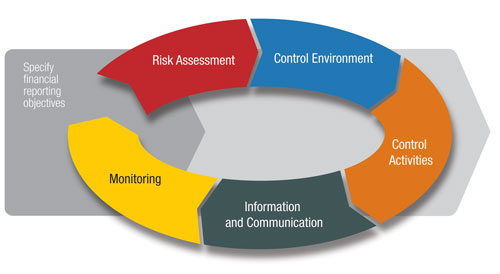

On May 14, 2013, the Committee of Sponsoring Organizations of the Treadway Commission (COSO) issued its final revised “Framework” for internal control reporting. Many accountants and other readers may raise the question, who is COSO and what do they do? Yes, accountants are quite familiar with guidance issued by the Financial Accounting Standards Board (FASB), the Securities and Exchange Commission (SEC), and other standard-setters, but COSO is not a standard-setter. So, this latest version of the COSO Framework arguably is a “sleeper” when it comes to guidance that may affect accountants.

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Lease Accounting, Audit Standards, Accountants

Will Proposed New Insurance Contract Accounting Rules Apply to You?

Posted by Ron Pippin on Thu, Jul 25, 2013

Companies and users of financial statements should be alert to the potentially far-reaching consequences of a June 27, 2013, proposal issued by the U.S. Financial Accounting Standards Board (FASB). If adopted, the proposal would likely change how certain companies that provide insurance (not policyholders) account for insurance contracts. Maybe most importantly, the proposal would affect financial accounting by many companies that don’t consider themselves an “insurance company.” Financial institutions, including banks, are just one example. Undoubtedly, the scope of this proposal will surprise many—possibly even the FASB. This proposal, titled Insurance Contracts (Topic 834), is a whopping 405 pages in length—not exactly light reading!

Tags: Corporate Governance, Business & Legal, Accounting & Tax, Audit Standards, Accountants, US GAAP, GAAP, Insurance

.jpg)