Audit, Compliance and Risk Blog

CEO/Worker Pay Ratio—SEC Proposes Controversial and Costly Statistic

Posted by Ron Pippin on Wed, Oct 02, 2013

Tags: Corporate Governance, SEC, Accounting & Tax, Accountants

Tags: SEC, Accounting & Tax, Lease Accounting, Audit Standards, Accountants

Significant New Auditing Standards—Part 2, Tenure/Other Information

Posted by Ron Pippin on Wed, Aug 28, 2013

This is the second of a two-part discussion on the August 13, 2013, the Public Company Accounting Oversight Board (PCAOB) proposal that would result in two new auditing standards. In the first article, I discussed the proposed concept of “critical audit matters” or CAMs. In this article, I discuss the proposed requirements to disclose how long the auditor has been auditing the company and to provide some assurance on “other information” that a registrant must file in an annual filing with the Securities and Exchange Commission (SEC). I conclude this article with some summary thoughts.

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Audit Standards, Accountants

Significant New Auditing Standards—Part 1, Critical Audit Matters

Posted by Ron Pippin on Fri, Aug 23, 2013

On August 13, 2013, the Public Company Accounting Oversight Board (PCAOB) issued a lengthy, 294-page proposal that would create two new auditing standards and amend several existing rules. If finalized, it will likely increase the work load of auditors. Presumably, the PCAOB proposed these rules, not to “help” the pocketbooks of auditors but rather to provide more useful information to investors. Much of this proposal resulted from feedback the PCAOB received on its June 21, 2011, “concept release” on possible changes to the auditor’s reporting model. The PCAOB has now answered my question from a prior blog article, “Where Is the Regulator of Auditors of Public Companies?"

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Audit Standards, Accountants

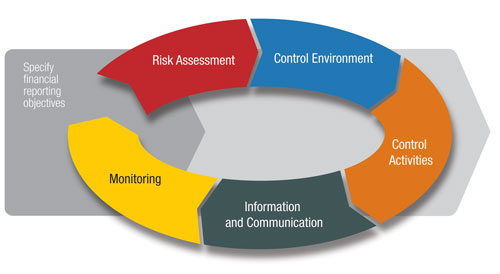

On May 14, 2013, the Committee of Sponsoring Organizations of the Treadway Commission (COSO) issued its final revised “Framework” for internal control reporting. Many accountants and other readers may raise the question, who is COSO and what do they do? Yes, accountants are quite familiar with guidance issued by the Financial Accounting Standards Board (FASB), the Securities and Exchange Commission (SEC), and other standard-setters, but COSO is not a standard-setter. So, this latest version of the COSO Framework arguably is a “sleeper” when it comes to guidance that may affect accountants.

Tags: Corporate Governance, Business & Legal, SEC, Accounting & Tax, Lease Accounting, Audit Standards, Accountants

Will Proposed New Insurance Contract Accounting Rules Apply to You?

Posted by Ron Pippin on Thu, Jul 25, 2013

Companies and users of financial statements should be alert to the potentially far-reaching consequences of a June 27, 2013, proposal issued by the U.S. Financial Accounting Standards Board (FASB). If adopted, the proposal would likely change how certain companies that provide insurance (not policyholders) account for insurance contracts. Maybe most importantly, the proposal would affect financial accounting by many companies that don’t consider themselves an “insurance company.” Financial institutions, including banks, are just one example. Undoubtedly, the scope of this proposal will surprise many—possibly even the FASB. This proposal, titled Insurance Contracts (Topic 834), is a whopping 405 pages in length—not exactly light reading!

Tags: Corporate Governance, Business & Legal, Accounting & Tax, Audit Standards, Accountants, US GAAP, GAAP, Insurance

FASB Proposes Selected “Breaks” for Private Companies from U.S. GAAP

Posted by Ron Pippin on Mon, Jul 08, 2013

On July 1, 2013, the FASB issued three proposals designed to reduce the complexity of certain accounting requirements for private companies. While that is certainly the intent, some unintended consequences may result as discussed below.

Tags: Business & Legal, SEC, Accounting & Tax, Accountants, US GAAP, GAAP

FASB Receives Report Card on Business Combination Accounting Rule

Posted by Ron Pippin on Thu, Jun 27, 2013

On May 22, 2013, the Financial Accounting Foundation (FAF) issued a post-implementation review (PIR) report on the accounting rule that the Financial Accounting Standards Board (FASB) prescribes for business combination accounting—specifically, FASB Statement No. 141 (Revised 2007), Business Combinations, now codified into FASB Codification Topic 805. In general, the report found that Statement 141(R) improved rules for the purchase method of accounting for business combinations but that problems remain, particularly in relation to fair value measurements. The PIR report also acknowledges unexpected compliance costs for companies that have applied the requirements in Statement 141(R).

Tags: Business & Legal, Accounting & Tax, Accountants, IFRS, Decision on IFRS

As mentioned in my September 2012 blog article, “Possible New Lease Accounting Rule—An Update,” a new proposal for lease accounting was likely to “hit the streets” sometime in 2013. Sure enough, a new proposal was issued on May 16, 2013. This proposal was issued jointly by the U.S. accounting standard-setter, the Financial Accounting Standards Board (FASB), and the International Accounting Standards Board (IASB), which issues accounting standards that are used by many companies in countries outside the United States. The two boards are striving to conform their accounting principles and this lease project is one example of that effort.

Tags: SEC, Accounting & Tax, Lease Accounting, Accountants

PCAOB Becomes Latest Regulator to Encourage Self-Policing

Posted by Jon Elliott on Tue, May 21, 2013

The latest regulator to establish a formal policy offering companies incentives to self-police is the Public Company Accounting Oversight Board (PCAOB), which regulates the accountants that audit the books for public companies and broker-dealers and help prepare their periodic reports. On April 24, PCAOB issued its “Policy Statement on Extraordinary Cooperation in Connection with Board Investigations.” This Policy Statement formalizes guidance to auditors, explaining how PCAOB’s inspection and enforcement personnel view regulated entities’ willingness to go beyond mere compliance, by taking steps such as:

Tags: Business & Legal, SEC, Accounting & Tax, Accountants

.jpg)

.jpg)